Breaking the Mold

The gaming industry has continued to adapt and evolve as technological shifts, consumer preferences, and regulatory changes impact how games are created, distributed, monetized, and played. That said, when it comes to monetization specifically, innovation in games has stagnated over the last 5 years, with the latest model being monetization through UGC-driven platforms and marketplaces. We believe that a new business model in games will soon materialize.

There are 3 major and recent examples that illustrate how gaming trends guide new models:

- Advertising: The launch of a new distribution channel led to the emergence of advertising as a business model, which in turn drove the rise and fall of the hypercasual genre. The launch of the App Store in 2008 centralized game distribution on mobile and made it easier for developers to reach a global audience. The developers of these games benefited from the volume unlocked and could afford to remove the barrier to entry (free-to-play) and experiment with other methods of monetization such as advertising and in-app purchases (IAP). Advancements in advertising technologies and strategies such as programmatic ad buying, real-time bidding (RTB), cross-promotion, and automated bidding strategies such as Target Return on Ad Spend (tROAS) made advertising viable as a core economic model, leading to the rise of the hypercasual genre. However, IDFA deprecation had the opposite effect, making hypercasual profitability through ads unfeasible, effectively killing the genre.

- Battle passes: Battle passes are one-time purchases that provide players with a progression system where they can earn rewards by completing in-game challenges. They are unique in that there is not a defined tradeoff in the transaction - players unlock more rewards the more they play. Battle passes were first introduced by Valve for DOTA 2 in 2013 as a way to boost funding for their major esports tournament while still engaging players. Interestingly enough, the battle pass model did not lead to growth of the esports side of the industry (esports instead went the sponsorships and merchandise-driven route, which we now know was unsustainable and short sighted); instead, the model was adopted by free-to-play (F2P) games. Specifically, battle passes were popularized by Fortnite in 2017 as a way to introduce a new, transparent revenue stream into the F2P game that was complimentary to their season-based content structure while enhancing engagement for an already-competitive player base. Other games such as PUBG, Call of Duty, and Rocket League quickly followed suit within 12 months.

- Subscription x distribution: Subscription services in more recent years have also revolutionized the way that players discover and access games. Subscriptions such as Xbox Game Pass, NVIDIA GeForce Now (cloud gaming), Playstation Plus, and Apple Arcade have put thousands of games into the hands of gamers for a reasonable monthly fee which has shifted the economics of game discovery and distribution forever. However, owning this layer is limited to a privileged few already-large gaming companies, many who entered through hardware-led strategies for the purpose of owning the entire ecosystem.

Advertising, battle passes and subscription services are only 3 examples of business models that evolved due to changing market conditions. With these foundational shifts in mind, this week, we are taking a closer look at how different monetization strategies have evolved and where the monetization opportunities lie for game developers and players in this rapidly changing environment.

Mix-and-Match: Overview of In-game Monetization

Even in-game business models have been influenced by different trends within the gaming industry. Some have stronger staying power and relevance than others but many modern games use a combination of these models:

- Direct exchanges between players and the game: This category is inclusive of any purchase where the player knows exactly what they are purchasing: content (e.g., DLCs), items, or in-game currency via a one-time purchase (e.g., battle passes) or subscription (e.g, Xbox Game Pass, Roblox Premium). This method of monetization is transparent and typically optional for players. The strength of this revenue stream is affected by macroeconomic conditions due to its discretionary nature which is especially exacerbated in F2P games. Regardless, this type of revenue stream will always be a mainstay in the gaming industry due to its customizability (liked by developers) and transparency (liked by players).

- Player-to-player exchanges (Marketplaces / User-Generated Content): Games that monetize through this revenue stream typically take a percentage of the value of the exchange, which can be items, services, or content (e.g., Roblox user-generated games). Players set the price of their goods or services which is affected by market supply and demand. This revenue stream is subject to thinner margins than player and game exchanges due to multiple stakeholders being involved such as the buyer, seller, creator, brand partner, and user acquisition (UA) method (e.g., influencer). To profit from this revenue stream, these games require a significant amount of volume exchanged, limiting this model to already-successful games and platforms. These companies must scale through alternative revenue streams or risk being dependent long-term on external capital (e.g., VCs, crowdfunding).

- Chance and skill: Loot boxes are packages obtained through gameplay or purchase where the contents are unknown before opening; the player receives items upon opening based on static odds. Gacha systems are similar to loot boxes but with scaling odds: spending more increases the chances of getting rare items. Games that monetize this way typically have a disproportionate amount of revenue coming from “whales”, or high-spend players: ~90% of loot box revenue (~$15b a year) comes from a small group of whales. Despite its lucrative nature, revenue streams based on chance face an uncertain future due to their likeness to gambling and have faced legal headwinds. While still a gray area, games of skill are likely to face less regulatory hurdles - we at Konvoy are bullish on platforms that enable players to bet on themselves as they monetize their most invested and engaged players.

- Sponsorships: Sponsorships have evolved significantly in the last decade. A brand can integrate directly into the game through items (e.g., Louis Voutton skins in League of Legends) or environments (e.g., Spotify Island) or through more “traditional” sponsorship via esports. While this revenue stream can be valuable, it is typically not accessible by non-AAA games and lacks scalability. Despite this, we believe that paid brand presence in games will increase over time.

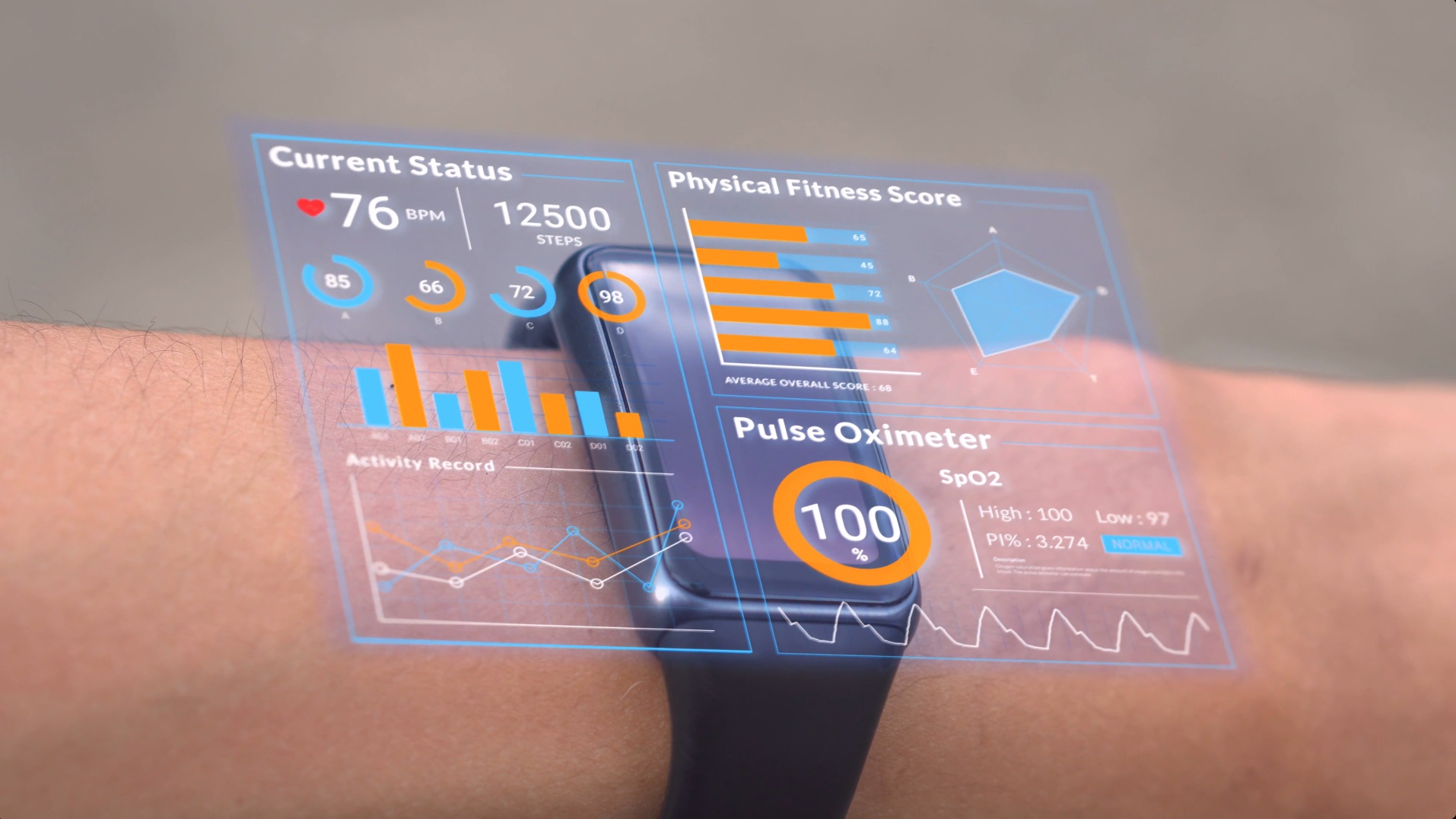

- Data Monetization: Games, in particular mobile games, have the ability to collect a significant amount of data on their players. While some of this data can be used to improve gameplay, it can also be used as a revenue stream such as selling data to marketers or by targeting players for IAP, cross-promotion into other games and advertisements. As we touched upon earlier, we believe advertising will always be a passive revenue stream that will continue to have suppressed if not declining efficacy. In addition to this, games that currently monetize from the sale of player data (behavioral, social, biometric) are already seeing increased pressure from consumer protection legislation (COPPA, GDPR, PECR, CCPA). It is unlikely that this will be a strong revenue stream in the future.

New Monetization Models Will Emerge

We believe that there are four key indicators suggesting the likely emergence of a new business model in games:

- Maturation of the gaming market: Today, ~42% of the global population plays games. While the gaming market has continued to grow (~$189b in 2024), we are reaching saturation of exposure to gaming, especially based on current relevant audiences. In a study by Deloitte, they found that 87% of Gen Z respondents played games weekly. In other words, while gamers have always been known to be a fickle group, especially when it comes to monetization, gaming as a whole is “mainstream”.

- Shift in value-creation and economics: UGC platforms like Roblox have, in the last decade, revolutionized how value is created and accrued in gaming by empowering players to make games. This has evolved in the last 5 years to include other value creators such as brands. Key stakeholders for any given platform can include the developer, publisher, distribution platform (e.g., Roblox, Game Pass), payment service providers, brand sponsors, and even influencers. The role of influencers in gaming has been relevant since the rise of YouTube and Twitch in the early 2010s, however, this has skyrocketed in recent years due to platforms like TikTok. The influencer marketing market has grown from $1.7b in 2016 to $24b in 2024 and is expected to grow at an average annual rate of +31.8% through 2028 (Influencer Marketing Benchmark Report).

- Shifts in the distribution and payments landscape: Epic Games (and specifically Tim Sweeney) has continued to battle existing app marketplace giants (Apple and Google) over distribution and payment practices. While there only have been geo-specific wins (Epic has launched their own game store in the EU) - this has implications on potential shifts in distribution and discovery. On the payments side, Apple now has to allow alternative payment processing options, but is still collecting up to a 27% commission on purchases made through alternative payment platforms (9to5Mac). We are optimistic that continuous pressure on these walled gardens will lead to major shifts in the way games are discovered, distributed and monetized; one medium we are especially interested in monitoring is the web.

- Major shifts in the mobile market: As we have alluded to earlier, decisions at the operating system (OS) level, regulation, and technological advancements have the power to make or break genres or entire distribution channels. IDFA depreciation killed hypercasual, a large driver of the growth of the mobile market, and mobile developers are still figuring out what works; this is reflected in the stagnation of mobile revenue. Additionally, there is increasing pressure for legislators to more strictly enforce consumer (and specifically child) protections. This will affect how player data will be collected and how players will be monetized.

Takeaway: The gaming industry is on the cusp of a major shift in monetization as macro trends and emerging technologies continue to mold the way the market grows. We believe that technological advancements, regulatory pressure on current business models such as advertising, loot boxes, and distribution, combined with the rising role of player-driven economies will enable new business models to emerge. Adapting will be key to staying competitive and meeting the ever-evolving expectations of gamers.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)